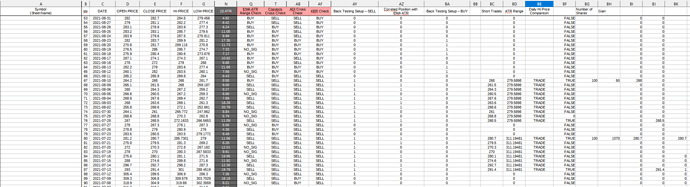

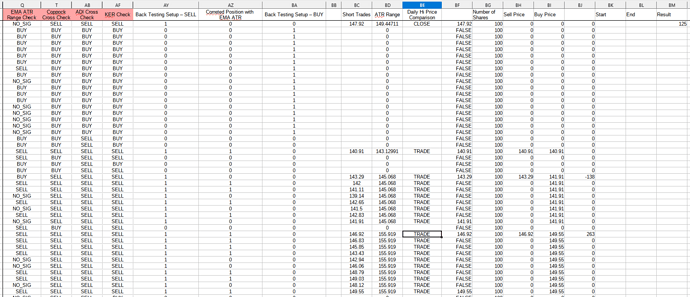

From the Image I have a value of 291.4 on the Low End, and 280.7 on the top end. And I want to know if there is a logic that I can right that does the following:

If (x is a number) and (x -1 == “”), Then the current value = x. This find the starting value.

then I want to substract the previous value from to end value which is denoted by:

if (y is a number and (y+1 == “”), then the end value is y. This will find the starting value.

I want to find a logic that allows me to dynamically perform this calculation without any manual work.

I’m essentially building a back testing spreadsheet. And I’m working if what I an trying to do is achievable without macros.

Many thanks.

I’ve Added a larger view of the data I’m working with.